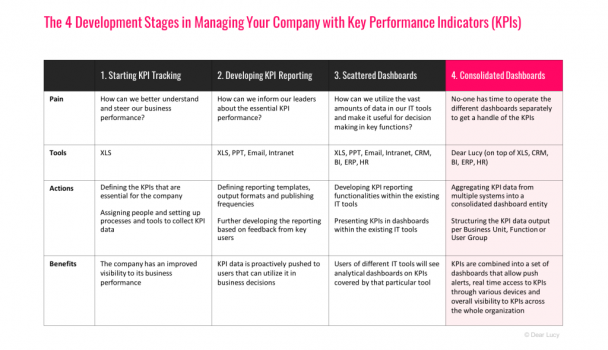

Takeoff Partners supports Inclus' international expansion

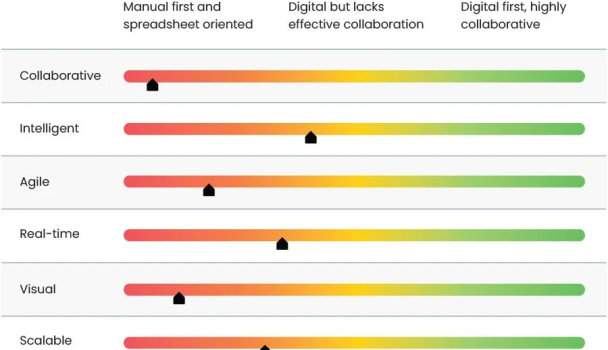

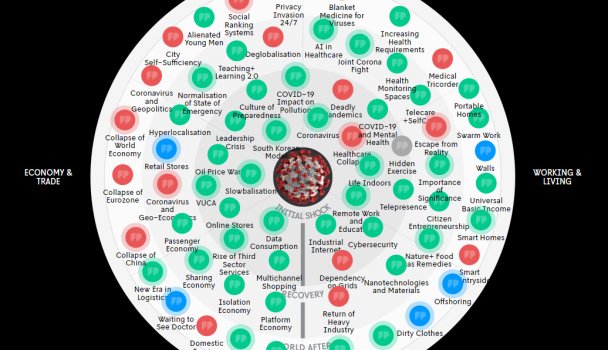

Based in Espoo, Finland, Inclus specializes in collaborative, AI-powered risk management software and services that help organizations identify, assess, and manage risks and opportunities in real-time.